The most influential white paper in history

What would you say was the most successful white paper ever written?

Hint: It turned 10 years old in October 2018.

Need another hint?

This paper proposed a whole new architecture for distributed databases.

One last hint: This paper was the starting point for the world’s most successful cryptocurrency.

If you said “the Bitcoin white paper!” I think you’re right.

That paper appeared in October 2008, written by Satoshi Nakamoto, a pseudonym used by the unknown person or group of people who authored it.

The Bitcoin paper exemplifies the very best in white papers:

- It’s clear and easy to read

- It contains facts and logic, not just opinions

- It’s long enough to explore the topic in depth

- It’s economical enough not to waste a word

All these qualities helped this document make an enduring impact on the world, far beyond what most white papers do.

Two Big Ideas in one paper

White paper writers often seek a Big Idea to frame their pieces.

The Bitcoin white paper presents not one, but two Big Ideas:

- A new form of digital cash ⇒ a “cryptocurrency”

- A secure way to handle electronic transactions without any central authority like a bank, or without either party even having to trust each other ⇒ a “blockchain”

One breakthrough idea would be enough. But having two makes this paper a towering achievement that started something truly historic.

And I’m not the only one who thinks so.

“Bitcoin White Paper Made Simple” is an e-book that seeks to explain this white paper to non-technical people. Here’s what it says:

The Bitcoin white paper is not only considered the most seminal piece of work in the cryptocurrency movement, it also gave birth to a transformative technology called blockchain.

And here’s what Don and Alex Tapscott say abut the Bitcoin white paper in their top-rated book Blockchain Revolution:

And here’s what Don and Alex Tapscott say abut the Bitcoin white paper in their top-rated book Blockchain Revolution:

Satoshi’s vision was stunning in its simplicity, originality and insight into humankind…

Blockchain technology has profound implications for many institutions…

Which helps explain all the excitement from many smart and influential people.

Consider the vast influence of this white paper

The Bitcoin white paper was not an overnight sensation.

At first, the paper was known only to a small band of cryptographers.

But over time, it attracted a wider circle of developers and investors. Eventually it gained momentum and snowballed into an unstoppable movement.

And a decade later, here are some measures of its impact on several fronts: media and awareness, investment, technology, jobs, and all-around traction.

Media and awareness

In 2016 and 2017, Bitcoin had an extraordinary run up to its all-time high value of $19,783 in mid-December 2017.

Bitcoin was often covered in major publications such as The Economist, Forbes, The New York Times, The Wall Street Journal and Wired.

Today, nearly 4 out of 5 Americans have heard of Bitcoin. And many have heard of the underlying technology, blockchain.

That’s remarkable awareness sparked by a single white paper.

Cryptocurrency investment

Launched in early 2009, Bitcoin was the first successful cryptocurrency.

Over the past 10 years, more than 2,500 further alt-coins have been launched.

Of course, most of these pretenders will fail. But imitation is the sincerest form of flattery, right?

An Initial Coin Offering (ICO) is the most popular way to launch a new form of cryptocurrency. Here are some stats on the money raised through ICOs:

- 2014: $30 million from 7 ICOs (including $18.4 million for Ethereum, which issued the second most successful cryptocurrency, Ether)

- 2015: $8.6 million from 7 ICOs

- 2016: $256 million from 43 ICOs

- 2017: $5.48 billion from 343 ICOs

- 2018: $16.7 billion from 650 ICOs

That means in the past five years ICOs raised $22.5+ billion.

Despite the so-called “crash” from its historic high, Bitcoin’s value has recovered a lot of lost ground. As of mid-July 2019 Bitcoin still had a market capitalization of almost $185 billion.

Between Bitcoin and ICOs, that’s more than $200 billion.

Another source shows the total market cap of all cryptocurrencies as of this date at $270+ billion.

And it all started with one white paper.

Technology

This white paper proposed the blockchain, one of the most exciting breakthroughs in software in years.

Yes, the very first blockchain supports Bitcoin.

But blockchains can also be used without any cryptocurrency. In fact, blockchains are now being tested in every industry from aviation to warehousing, from art auctions to vote–counting.

And most analysts predict that over the next 20 years, blockchains will become a standard part of the business infrastructure.

That means blockchains will be used routinely behind the scenes, much like web servers or e-mail protocols.

Job prospects

One compelling benefit to business is to reduce processing costs with automated “smart contracts” that need little or no human intervention.

While this will likely reduce many rote office jobs, it is already creating tons of jobs in this emerging field.

For example, IBM is said to have 1,000 programmers working on blockchain for the Internet of Things. That’s just one company for one possible application space.

Any experienced blockchain developer can write their own ticket.

And there’s tons of work for any white paper writer who understands blockchain. For example, every ICO requires at least one white paper. And so does just about every blockchain startup and new applications.

Thank you, Satoshi.

Ongoing traction

Ten years after it was published, the Bitcoin white paper is still online and still being recommended to readers.

It has been cited by 5,000+ other papers proposing refinements or alternatives to its foundational ideas.

For many interesting perspectives on the impact of this white paper, see this roundup of opinions from some industry movers-and-shakers published by Coindesk.

The Bitcoin white paper is the standard, the exemplar, the touchstone for everything that came later.

Any regular white paper is considered wildly successful if it helps to sell a few million dollars worth of product.

What do you call a white paper that generates $70+ billion in investment, starts a whole new industry, profoundly affects the future direction of technology, creates and may destroy thousands of jobs, and introduces two Big Ideas that become known to billions of people?

I call it the most influential white paper ever published.

Presenting… the Bitcoin white paper

If you’re interested in white papers but you haven’t already seen this one, I highly recommend taking a look at it.

Click here or on the cover above to download the Bitcoin white paper.

While you’re reading, don’t worry if you don’t get all the math or the coding. I don’t either.

But we can still appreciate the brilliant insights in this white paper, and the wonderfully clear and disciplined way it was put together.

The next three sections analyze the structure, the format, and the contents of this ground-breaking white paper.

The Bitcoin white paper structure

The Bitcoin white paper is 9 pages or just over 3,500 words long.

This is average for a B2B white paper—but remarkably short for a document that achieved so much.

The “product” name appears in the title:

Bitcoin: A Peer-to-Peer Electronic Cash System

All the main sections flow smoothly from one to the next:

- Abstract sums up the paper in 180 words

- Introduction spells out the problem in less than 300 words

- Transactions to Privacy discuss features and benefits of the proposed solution

- Calculations provides formulas and code to prove that the system can actually work

- Conclusion sums up the key points in 180 words

- References point to 8 other books and papers published from 1957 on that support the key points of this paper

The Introduction touches lightly on the problem. Then the bulk of the paper describes the features of the proposed solution: the blockchain.

So with this structure, which of my three “ice cream” flavors does this represent?

So with this structure, which of my three “ice cream” flavors does this represent?

This structure is what I call a technical backgrounder, also known as vanilla. With this flavour, you know what you’re getting: a paper focused on a particular solution.

The Bitcoin white paper format

In a vanilla white paper, you can expect a traditional format with no fancy flourishes. And true to form, the look of the Bitcoin white paper is minimalist, like a journal article.

There is no cover, just a journal-style title page.

There is no color anywhere.

The single column of justified text is set in 10 point Times New Roman, surely the most generic of all typefaces.

Only a few text organizers break up the words:

- 6 block diagrams

- 1 numbered list

- about a dozen level-1 headings

You can also find several formulas and code samples. I won’t say these “break up” the text, since they take a lot of work to figure out. And by the way, these are all set in the default monospaced font, Courier.

All in all, the format is academic and unadorned.

This plain format was a strength rather than a weakness, since it felt familiar to the original audience of cryptographers and mathematicians.

Do you think a colorful stock photo on the cover would have appealed to those readers? Me neither.

The Bitcoin white paper style

The writing style is masterfully clear, precise, and economical. There isn’t a wasted word anywhere.

In fact, some people find the text so clear and idiomatic they believe the author must be a native English speaker, even though the pseudonym chosen by the author(s) suggests a Japanese origin.

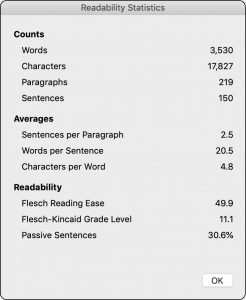

Let’s look a little closer at the writing style in this paper. Here are the readability metrics on the paper found with MS-Word.

Flesch Reading Ease out of 100 where the higher, the better: 49.9

This is an excellent score, far better than most white papers I see. I aim for 50 here myself.

Flesch-Kincaid Grade Level where the lower, the better: 11.1

I aim for 10 or 11 on white papers. This is right in the zone. That means a high school student can comfortably read this.

Passive Sentences where the lower, the better: 30.6%

It’s tough to write English without using 10% or 15% passive constructions. But at 30% this metric is double what I try to achieve in a white paper.

Passive voice in English uses more words but is less clear. That’s why professional writers and editors try to minimize it.

Academics tend to write using the passive voice, as in:

What is needed is an electronic payment system based on cryptographic proof instead of trust…

There’s nothing terrible about that phrasing. It’s clear enough. But grammar checkers will chalk it up as passive voice.

If I absolutely had to rewrite that, I would try something like this:

The world needs an electronic payment system based on cryptographic proof instead of trust…

What do you think: Is that any big improvement?

I don’t think so, and I would probably give the Bitcoin white paper writer a pass on the passive voice.

In any case, even with its relatively high score of 30% passive voice, this style probably sounds familiar to the intended audience of cryptographers and mathematicians.

The Bitcoin white paper content

Now let’s look at some specific passages to marvel at the ideas.

Here’s how the paper sums up the basic concept:

A purely peer-to-peer version of electronic cash would allow online payments to be sent directly from one party to another without going through a financial institution.

That’s it, in a nutshell. Blockchain gets rid of the middleman so people can deal directly with one another through the internet.

But how can you trust anyone else on the network?

The network timestamps transactions by hashing them into an ongoing chain of hash-based proof-of-work, forming a record that cannot be changed without redoing the proof-of-work.

In other words, you don’t have to trust anyone else. You can trust the code and the network.

The Conclusion sums up this idea in one sentence:

We proposed a peer-to-peer network using proof-of-work to record a public history of transactions that quickly becomes computationally impractical for an attacker to change if honest nodes control a majority of CPU power.

Since everyone on the network can see every transaction, no individual or small group can pull off a cheat unless they command at least 51% of the nodes on the network.

If you haven’t read the Bitcoin white paper, check it out for yourself.

What do you think of the Bitcoin white paper? Please leave your comments below.

Want to hear whenever there’s a fresh article on this site? Subscribe here to stay in the know on long-form content. From time to time, we’ll also send you word about some great new resource or training. And you can unsubscribe any time.

Thank you Gordon! This is exceptionally generous. I´ll print it and study it ASAP.

Regards!

An amazing post, Gord! At first I thought you were going to focus just on the impact of the white paper. Your analysis of the content is my big takeaway here.

As you point out “the Bitcoin white paper is minimalist, like a journal article” which I think fully explains the 30% passive voice sentences. That, I suspect, is pretty much the norm for academic papers — passive voice actual conveys authority is this context. “The world needs an electronic payment system based on cryptographic proof instead of trust…” would have been in bad form in this context.

Absolutely. A little passive voice is not a bad thing, and we both agree it did not detract from this paper.